By Kathleen Merrigan, Executive Director of the Swette Center for Sustainable Food Systems at Arizona State University

After several years of pandemic-driven price spikes at the grocery store, retail food price inflation is slowing down. That’s good news for consumers, especially those in low-income households, who spend a proportionally larger share of their income on food.

But there’s more to the cost of food than what we pay at the store. Producing, processing, transporting and marketing food creates costs all along the value chain. Many are borne by society as a whole or by communities and regions.

For example, farm runoff is a top cause of algae blooms and dead zones in rivers, lakes and bays. And food waste takes up one-fourth of the space in U.S. landfills, where it rots, generating methane that warms Earth’s climate.

Exploring these lesser-known costs is the first step toward reducing them. The key is a method called true cost accounting, which examines the economic, environmental, social and health impacts of food production and consumption to produce a broader picture of its costs and benefits.

Trillions of dollars in uncounted costs

Every year since 1947, the United Nations Food and Agriculture Organization has released an important and widely read report called The State of Food and Agriculture, known in the food sector as SOFA. SOFA 2023 examines how much more our food costs beyond what consumers pay at the grocery store.

Using true cost accounting, the report calculates that the global cost of the agrifood system in 2020 was up to US$12.7 trillion more than consumers paid at retail. That’s equivalent to about 10% of global gross domestic product, or $5 per person per day worldwide.

In traditional economics-speak, hidden costs are known as externalities – spillover effects from production that are caused by one party but paid for by another. Some externalities are positive. For example, birds, butterflies and insects pollinate crops at no charge, and everyone who eats those crops benefits. Others, such as pollution, are negative. Delivery trucks emit pollution, and everyone nearby breathes dirtier air.

True cost accounting seeks to make those externalities visible. To do this, scholars analyze data related to environmental, health, social and other costs and benefits, add them together and calculate a price tag that represents what food really costs.

The Swette Center for Sustainable Food Systems at Arizona State University, which I direct, recently conducted a true cost accounting study of cow-calf operations in the Western U.S., in partnership with Colorado State University. It found that the climate costs of these operations are very high – but that solving for climate change alone could threaten the livelihoods of 70,000 ranchers and the rural communities in which they live. A true cost accounting approach can illuminate the need for multidimensional solutions.

I study sustainable food systems and am one of 150 scholars across 33 countries who worked together over several years to design and test this new methodology. Our work was led by the U.N. Environment Program and partially funded by the Global Alliance for the Future of Food, a coalition of philanthropic foundations.

In many ways, true cost accounting is a modern and improved version of cost-benefit analysis, a method embedded in governmental decision-making in most advanced economies around the world. This approach quantifies expected rewards and costs associated with taking a particular action and then compares them to see whether the action is likely to produce a net gain or loss for the public.

Advocates of true cost accounting assert that its more nuanced approach will address shortcomings in traditional cost-benefit analysis – particularly, failing to consider social and health externalities in depth. The hope is that because these two methods have many similarities, it should be relatively easy for governments to upgrade to true cost accounting as it becomes more widely adopted.

True costs of food vary across countries

The 2023 State of Food and Agriculture report reveals some clear patterns. Of the $12.7 trillion in worldwide hidden costs that it tallies, 39% are generated by upper-middle-income countries and 36% by high-income countries.

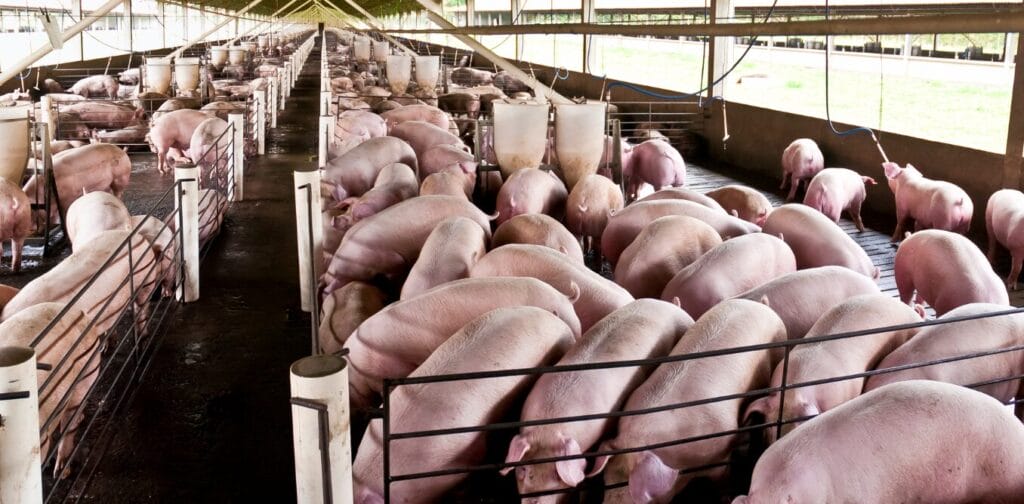

For wealthy countries, 84% of hidden costs derive from unhealthy dietary patterns, such as eating large quantities of red meat and heavily processed foods, which is associated with elevated risk of heart disease, cancer and other illnesses. Getting sick takes people away from work, so these health effects also reduce productivity, which affects the economy.

In contrast, 50% of the hidden costs of food in low-income countries are social costs that stem from poverty and undernourishment. SOFA 2023 estimates that incomes of poor people who produce food in low-income countries would need to increase by 57% for these workers to obtain sufficient revenue and calories for productive lives.

Food insecurity on farms is also an issue in the U.S., where the people who produce our food sometimes go hungry themselves. The food system’s reliance on undocumented and low-paid workers yields undernourished children who often are unable to learn.

The fact that many U.S. farmworkers lack access to health insurance also generates costs, since hospitals treat them at public expense when these workers fall sick or are injured.

Food production also has environmental costs. Nitrogen runoff, ammonia emissions, deforestation, water pollution and greenhouse gas emissions combined represent about 20% of the global hidden costs of food production. Other environmental costs, such as those associated with species loss and pesticide exposure, are not included in the SOFA analysis.

Should food cost more?

The first question people ask me about true cost accounting is whether using it will make food more expensive. Some advocates do argue for pricing food at a level that internalizes its hidden costs.

For example, a Dutch organization called True Price works with food companies to help them charge more accurate prices. The group operates a grocery store in Amsterdam that charges conventional prices but provides receipts that also display “true” prices, reflecting the goods’ hidden costs.

Consumers are encouraged to pay these higher prices. When they do, the store shares the proceeds with two nonprofit organizations that promote land and wildlife conservation and poverty reduction in Africa.

Rather than raising prices, I believe the most effective way to address the hidden costs of food would be to change government policies that provide $540 billion in agricultural subsidies worldwide every year. Of this amount, 87% goes to support production systems that produce cheap food, fiber and biofuels but also generate social and environmental harms. Examples include subsides that promote chemical fertilizer and pesticide use, overuse of natural resources and cultivation of emission-intensive products such as rice.

U.N. agencies have urged world leaders to redirect these subsidies to reduce negative impacts – a strategy they call “a multibillion-dollar opportunity to transform food systems.” While it may seem that eliminating subsidies would raise retail prices, that’s not necessarily true – especially if they are repurposed to support sustainable, equitable and efficient production.

Using true cost accounting as a guide, policymakers could reallocate some of these vast sums of money toward production methods that deliver net-positive benefits, such as expanding organic agriculture, agroforestry and sustainable fisheries. They also could invest in training and supporting next-generation food and agriculture leaders.

By creating transparency, true cost accounting can help shift money away from harmful food production systems and toward alternatives that protect resources and rural communities. Doing so could reduce the hidden costs of feeding the world.

This article was originally published in The Conversation.