The fall of cryptocurrencies in 2018 had far reaching effects for the digital currency market. Bitcoin remains more than 200% below its all-time-high even in 2020. Although shaking the public’s trust, the capital assets invested into blockchain have more than tripled. With companies such as IBM investing 1,500 employees into over 500 blockchain projects, JP Morgan implementing its digital currency to over 200 clients, and angel investments of $23 billion in 2019, blockchain has seen imperturbable growth in the corporate sector. But why? To understand these investments, let’s begin by understanding what exactly a blockchain provides and how it differentiates from alternative modern applications.

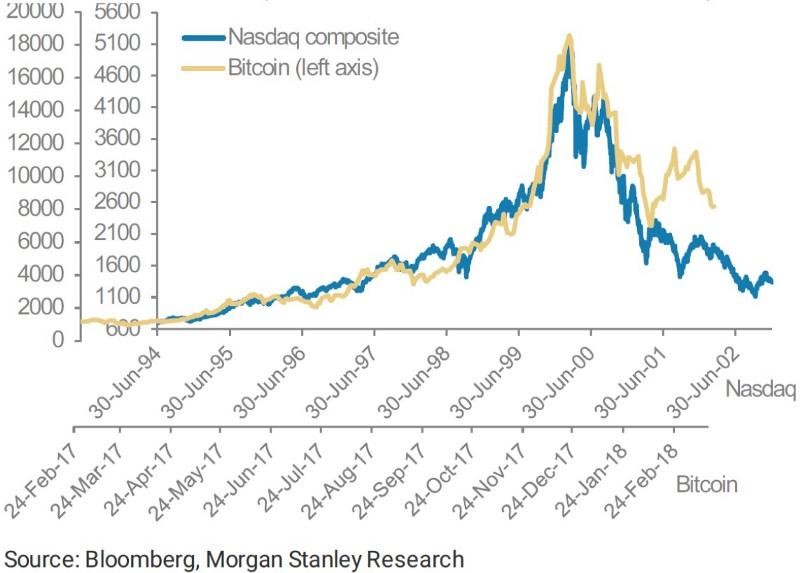

An analysis between the bitcoin boom of 2018 to the dot-com bubble. The impact of dot-com’s FOMO on the hype of Bitcoin is an interesting contrast.

History of data storage

June 1970-The first proposal of a Relational Database Management System (RDBMS) was released by Edgar F. Codd. This form of data storage has carried the world’s business needs for over 50 years. Only within the last 2 decades have we seen the prolific spread of other forms of data storage, such as NoSQL and most recently, blockchain. Databases provide features such as security, permissions, vertical scalability, and ACID transactions. Given the benefits above, it is fundamental to consider the limitations of a traditional RDBMS for your business use case prior to investing in blockchain.

A shallow dive into blockchain

From a computing point of view, the core of blockchain is simply another data structure. A data structure is an organization of data that aims to provide efficient access, storage, and management. There are several data structures, optimized for various use cases: for example, the filesystem of a computer organizes data (files) into a structure for easy human readability. As a distributed ledger, data organization is at the core of blockchain. The addition of computing concepts, such as cryptography, distributed systems, and networking, fabricates the overall ecosystem of blockchain that we know provides immutability, transparency, and redundancy.

The Fine Lines

An unfortunate representation of a high percentage of blockchain implementations

A Decentralized Database

A trustless system is a byproduct of decentralized blockchain implementations, in which a user does not need to know or trust information from any other party. Traditional databases, such as Postgres or MySQL, cannot offer this benefit, as they are meant to store data in a centralized server. Moreover, they are optimized for data manipulation and any involved party may transform the data. The benefit of this implementation is speed and scalability. On the other hand, a blockchain makes these trade-offs to optimize for data redundancy, security, and trust.

An implementation that takes advantage of this trustless nature is Grid+, a blockchain startup operated by ConsenSys. By providing a peer to peer energy trading platform, Grid+ allows users to save money on their energy expenses by trading with their neighbors, selling excess solar energy, and directing their unused electricity to others. This application utilizes distributed ledgers and smart contract automation in order to provide an energy market that cuts out all middlemen. As a result, consumers not only enjoy lower costs, but also the transparency of each purchase (as all transactions are recorded and visible on the public ledger). Furthermore, a P2P energy market can reduce energy usage by over 20%, due to the reduction in long-distance energy transfer.

Visualization on the key differences between a blockchain and a database

A centralized blockchain

Aside from the traditional decentralized application, several other forms of blockchain architectures have been developed, each making their own trade-offs. A permissioned blockchain, the antithesis of Satoshi’s decentralized blockchain vision, is among the most common modern use-case. It promotes the benefits of blockchain but permits data centralization to specific entities. The result of this application is not only the benefit of speed, but the possibility of horizontal/vertical scalability, data privacy, and distributed ledger technology. As a result, this interface is much more relevant to corporate businesses, due to the need for private data.

Honeywell is currently in progress of implementing Hyperledger Fabric, a permissioned blockchain framework, to their supply chain, a $1 billion venture. This implementation aims to keep a tamper-proof digital copy of physical assets (in this case, plane parts from Boeing) in order to ensure procurement safety compliance from the point of origin to consumer delivery. Honeywell’s infrastructure utilizes permissioned blockchain benefits, such as immutability, private channel communication, and distributed ledger technology, to verify that Boeing, their supplier, is indeed following regulations/safety in a unified, interoperable, and tamper-proof manner. Considering the latest news on Boeing, this blockchain implementation is worth the safety of millions of lives.

Conclusion

Evidently, blockchain technology, for tamper-proof needs, is an excellent implementation, having the potential to transform markets that require trust. This is why blockchain is a useful data structure; it is simply a variation of traditional databases that is optimized for a different set of needs. RDBMS are still the better use-case for projects that require a central party or for applications that don’t require transparency.

On the other hand, blockchain excels as a choice for an environment with multiple parties. The provision of a smart contract layer to interact with the global state ledger is an invaluable architecture, conceiving a data commons. for multiple parties to interact in a trustable manner. The increased blurring between centralization and blockchain makes it more difficult for businesses to define their blockchain use-case; options of centralized, decentralized, and hybrid approaches require thorough business analysis to develop a successful blockchain implementation. Part 2 will provide a decision making framework to outline the needs of blockchain for your organization, or to determine if your solution is simply looking for a question.

________________________________________

LightWorks® Innovation Accelerator provides connectivity between ASU assets and researchers + government agencies, NGOs and corporations to solve sustainability challenges. Expanding on “Light-Inspired Solutions” and clean energy innovations, the LightWorks® Innovation Accelerator explores solutions in a broad range of sectors including: The Carbon Economy, Food Systems, IoT, Green Finance, Sustainable Engineering, and Clean Water.